Beginner's Guide : How to Start Using the Touch ‘n Go eWallet App in Malaysia

- Erik & Aya

- 3 days ago

- 7 min read

Updated: 13 hours ago

September 2025

Have you just started living in Malaysia and wondered how to make public transportation and cashless payments more convenient? The Touch ‘n Go eWallet App is a very handy digital wallet app for starting a cashless lifestyle in Malaysia. In this guide, we will explain everything from downloading the app to the basics of using it. Hereafter, we will simply refer to the Touch ‘n Go eWallet App as “the app.”

1. What is Touch ‘n Go? (Difference Between the Card and the App)

Touch ‘n Go is a widely used e-money system in Malaysia. It originally started as a physical Touch ‘n Go card for paying highway tolls. Today, there is also the Touch ‘n Go eWallet App, which allows you to top up and make payments easily using your smartphone. The names are similar, so it can be confusing, but it’s important to understand that the card and the app are separate and function independently.

🌟 Differences Between the Card and the App

In Malaysia, it’s convenient to use the card and the app for different purposes. The Touch ‘n Go card is a physical card mainly used for public transportation, while the app is used on your smartphone for cashless payments at restaurants, shops, and other purchases.

You cannot use a smartphone with the app to tap through train gates or highway tolls. Likewise, it is generally not common to use the physical Touch ‘n Go card for paying for meals or shopping just because it has a balance—there are some exceptions, but they are limited.

As a rule of thumb, residents generally use the card and the app as follows:

Touch ‘n Go Card (Plastic IC Card)

Main Uses

Paying highway tolls

Paying for public transportation (buses, trains, etc.)

Paying for parking at shopping malls and other facilities

Touch ‘n Go eWallet App (Digital Wallet App)

Main Uses

Cashless payments at shops, cafés, restaurants, and more

Online shopping

Sending money to other people

🌟 Separate but Can Be Linked

The Touch ‘n Go card and eWallet app are originally separate systems.

While they can be used independently, there is a convenient feature called linking.

Benefits of Linking:

Check Card BalanceChecking the balance on the card alone can be a bit cumbersome, but once linked to the app, you can easily view it anytime on your smartphone.

Top-Up Card from the AppTraditionally, adding money to a Touch ‘n Go card required going to designated stores or machines. While that is still possible, linking the card to the app allows you to transfer money to the card directly from your smartphone. This makes topping up for public transportation much easier.

In short, you can use the card and the app separately, or combine them by managing the card through the app, which makes life more convenient. In the rest of this guide, we’ll take a closer look at using the app!

2. How to Download the Touch ‘n Go eWallet App

①Open Your Smartphone’s App Store

iPhone: Open the App Store

Android: Open Google Play

②Search for “Touch ‘n Go eWallet”

The official name is Touch ‘n Go eWallet

③Install the App

After downloading, the app will be added to your smartphone

3. Registering an Account

① Open the App

Launch the Touch ‘n Go eWallet app on your smartphone.

② Select “Sign Up”

③ Enter Your Phone Number

Use a Malaysian phone number. Foreign numbers cannot be registered.

A Malaysian phone number is required because the app sends an SMS verification code (One-Time Password / OTP) during registration.

If you’ve just moved to Malaysia, first get a SIM card or a prepaid SIM, then use that number to register for the app.

④ SMS Verification (OTP)

OTP stands for One-Time Password.

A 6-digit code will be sent to your phone via SMS. Enter it into the app to verify your identity.

⑤ Set a 6-Digit PIN

After OTP verification, set a 6-digit PIN in the app.

This PIN acts as a security code for payments and transfers, similar to an ATM PIN.

Remember your PIN, as you’ll need it for all transactions.

⑥ Enter Personal Information

Input your name, identification number (MyKad or passport), date of birth, and other required details.

4. How to Top Up (Add Funds)

Before you can start making payments with the app, you need to top up your balance.All payments are deducted from this balance, so you cannot make payments or send money if your balance is zero.

① Top Up via Debit or Credit Card

Tap “Add Money” in the app and top up using a debit or credit card.

For the first time, you’ll need to register your bank account or card information.

Note: Only Malaysian-issued debit or credit cards can be registered. This can be challenging for travelers or those without a local bank account.

②Top Up with Cash at Convenience Stores (“Reload PIN”)

You can top up with cash at participating convenience stores such as 7-Eleven and MyNEWS.

This method works even if you don’t have a Malaysian debit or credit card!

How to Top Up:

At the counter, tell the cashier “Touch ‘n Go eWallet top-up” and state the amount you want to add.

The cashier can scan the QR code in your app to complete the top-up, or

You will receive a receipt with a PIN number.

Open the app, tap “Add Money”, then select “Reload PIN”, and enter the PIN from the receipt.

The cash amount will then be added to your eWallet balance.

③ Top Up via Online Banking

You can also top up your eWallet through Malaysian online banking.

This method is done from your bank’s online banking portal, not the app itself.

You transfer money from your bank account directly to your Touch ‘n Go eWallet.

5. How to Make Payments

The Touch ‘n Go eWallet primarily uses QR code payments.

①At a store, simply tell the cashier: “I’ll pay with Touch ‘n Go.”

② Using the App to Scan or Pay

Tap the button at the bottom of the app (as indicated by the arrow in the photo) to open the “Scan” screen.

Scan the QR code displayed near the store’s cashier.

Alternatively, in the app’s “Scan” screen, switch to the “Pay” tab and let the cashier scan your barcode.

The payment method depends on how the store processes transactions, so choose the option that matches their setup.

③ Confirm the Payment Amount

Check the amount displayed and proceed with the payment.

④ Payment Complete!

The transaction is done, and you can also view the receipt within the app.

🌟 Which Payment Method is Convenient at Malaysian Restaurants: Cash, Credit/Debit Card, or eWallet?

For short-term travelers, using the Touch ‘n Go eWallet app is generally not an option, as a Malaysian phone number is required for registration. Here’s a quick overview from the perspective of residents regarding payments at restaurants:

Nowadays, some stores do not accept cash, while others do not accept credit/debit cards.

Some restaurants avoid handling cash for operational reasons.

Small shops may not accept cards due to transaction fees.

As a result, availability varies from place to place. You might find one restaurant that doesn’t accept cash and another that doesn’t accept cards.

Don’t worry: You won’t encounter a situation where you cannot enter any restaurant without the app.

That said, many restaurants and even small street vendors, like fruit trucks or stalls, accept Touch ‘n Go eWallet payments, as it has become widely used.

Important: Always be prepared for situations like your phone running out of battery or having internet connectivity issues.

6. Useful Features

① Money Transfer: Send Funds Instantly to Friends or Family

When dining out with friends and splitting the bill, you can use the app to send money even if you don’t have small cash on hand.

Tap “Transfer” in the app, select the friend from your contacts, enter the amount, confirm, and send.

② Paying for Street Parking

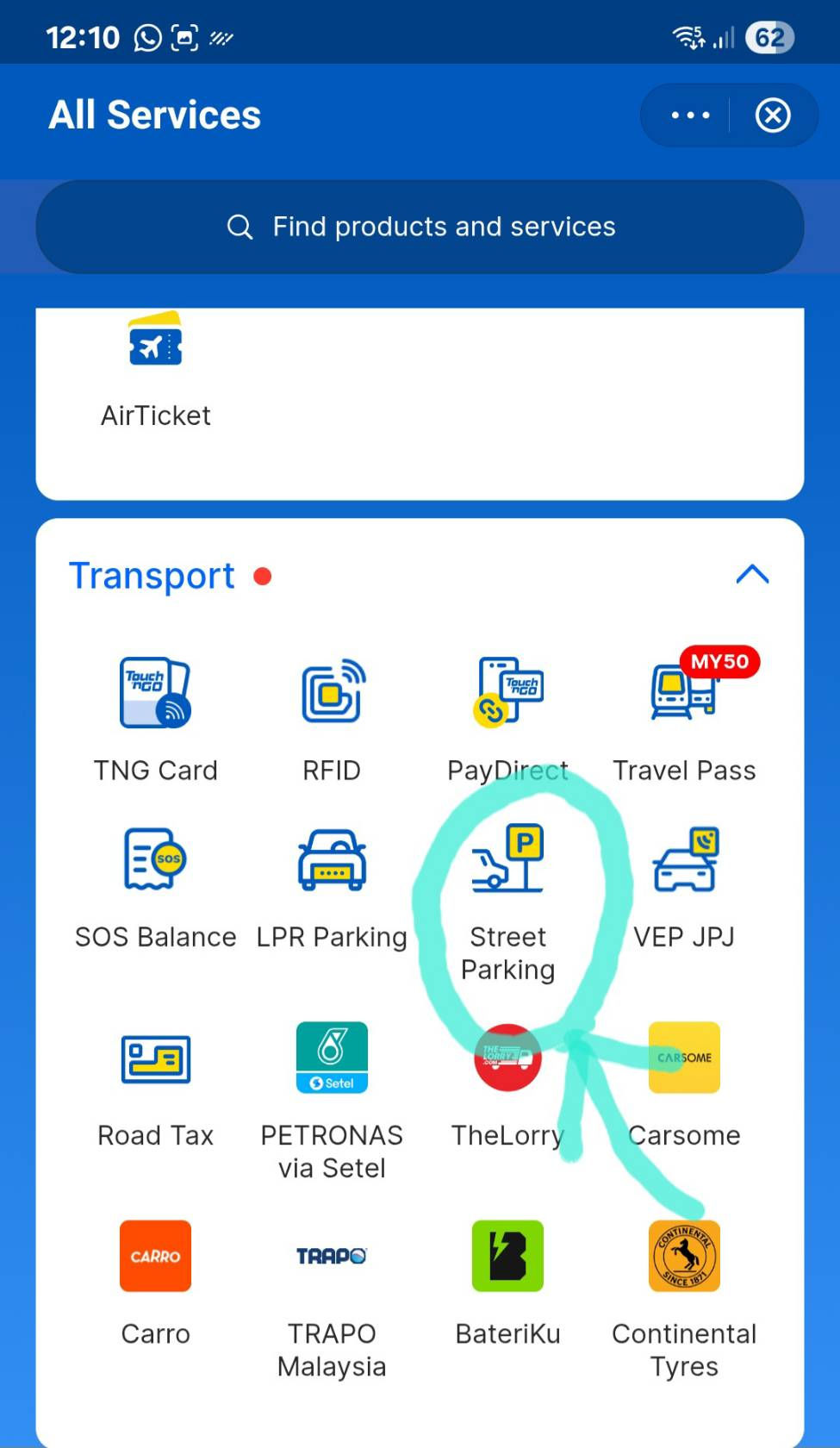

When you park your car on the street (for example, in shop lot parking spaces), you can pay the parking fee directly through the app. Since there are often no attendants nearby or visible payment machines, it’s easy to overlook how to pay. However, if you park without paying, enforcement officers may patrol the area and issue a parking ticket. To avoid this, it’s best to pay securely through the app.

Street parking fees can be paid using various apps, but with Touch ‘n Go eWallet, you can do it directly:

In the app, go to “My Favourites” → “More” → “Transport” → “Street Parking.”

Tap “Pay For Parking Now.”

Select your parking location. (In Selangor, parking areas are divided into zones, so you need to know which zone you’re in.)

Choose the specific area, register your car license plate number, and select the parking duration.

This way, you can pay conveniently and avoid fines.

③ Online Shopping Payments

You can use the app for payments on platforms like Shopee and Lazada, as well as for many other types of shopping.

④ Highway Toll Payments via “PayDirect”

At certain highways, you can use the PayDirect feature. Even if you tap your physical Touch ‘n Go card at the toll booth, the toll fee will be deducted from your app balance if the card has been linked to your eWallet in advance.

For details on which highways support this feature, check the official website’s PayDirect page.

As of 2025, not all highways in the Klang Valley support PayDirect.

If you want to start a cashless lifestyle in Malaysia, the Touch ‘n Go eWallet app is a must-have. By learning how to use both the card and the app effectively, you can make your daily life—whether it’s commuting, shopping, or transferring money—smooth and convenient.

👉 At Tabiniko, we provide comprehensive support for your life in Malaysia — from real estate investment to relocation, educational migration, and MM2H assistance. Feel free to contact us!

📚 Sources

The official website for Touch ‘n Go eWallet:https://www.touchngo.com.my/ewallet/

The official YouTube channel for Touch ‘n Go:www.youtube.com/@touchngoewallet8576